Our technical analyst Tim Morris guides us through analysing and optimising your advertising channels in order to understand - and increase - return on investment.

The phrase ‘return on investment’, or ROI, is one of the oldest and most popular concepts in marketing: you should aim to make more money than you’re spending. It just makes sense.

Nowadays however, it’s become such a cliche that you’re more likely to hear it alongside phrases like ‘growth hacking’ and ‘blue sky thinking’ in a mockery of marketing jargon. The phrase has come full circle from being so overused it’s cliche, to so cliche it’s taboo. The fallout is that many businesses have stopped thoroughly exploring how it applies to them.

At the end of the day, if you’re making money, you’ve got a positive ROI. Job done, right? Not if you want to hack your growth up into that big blue sky! To get an edge over the competition, the most efficient businesses will drill down into each channel and measure ROI at the source.

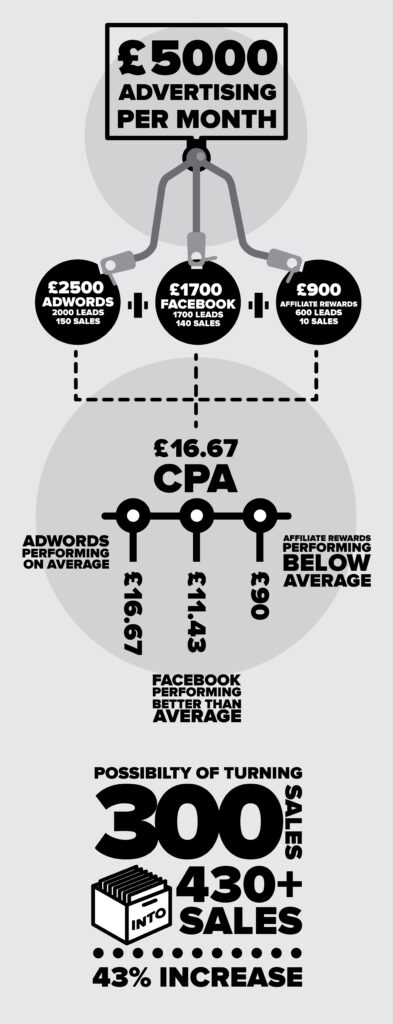

As an example, Low Fidelity are a fictional record store specialising in secondhand and rare vinyl. Recently their online store has exploded, and each month they spend £5,000 on advertising, making a tidy profit.

There’s a lot to figure out even in those three channels, but on the face of things Facebook can already be seen to cost a third of the budget but bring in almost half the sales. If we swapped budgets and conversion rates remained the same, we could see the same spend securing more sales. With those numbers Facebook could even be the sole channel for the business.

And that is exactly what proper analysis of ROI can do for a business - inform huge strategic decisions through data. If you’ve worked every variable out, you can act more safely in the knowledge that your investment will bring in a return.

However, it’s not enough to simply know which channel does best and then focus on it. If you want to truly master ROI, you’ll need another phrase and its acronym: lifetime value, or LTV. This is the value of each and every new customer you secure, from their first purchase to their last. It also doubles up as a limit on how much we can spend on bringing in a new customer.

What we need to know is how much customers spend, how much of that is your profit margin (that you’re happy to reinvest), and also your churn rate. Churn rate can mean a few things to different businesses, but generally it represents how many purchases you expect your customers to make.

For example an 8.3% (or as a fraction 1/12) churn rate is

If we have

We’d calculate that as

So even though our average sale, or monthly subscription is only £16, we actually have £19.28 from each every customer that we would be happy to spend on securing another new customer!

This is huge news for Low Fidelity, as they’ve been spending £16.67 (£5,000 spend, 300 new sales) on average per new customer they’ve secured, also known as their Cost Per Acquisition or CPA.

Adwords came in exactly at that average point - it’s doing fine. Facebook, however, hit £11.43 per new sale, far under what they could be spending. Affiliate rewards cost them a whopping £90 per new sale though.

For a company just watching their overall profit margin, they might just be happy with the way things are. However for a company who takes a good look at their ROI, LTV, and CPA they can make huge decisions.

This means that Low Fidelity can now move more budget into Facebook, giving it the lion’s share of ad spend. This will lower their CPA, letting their budget go that much further. It’s important to note, though, that the return will likely shrink as the budget for Facebook increases. However, it’s obvious that there’s room for growth there. They can also take their Affiliate scheme back to the drawing board, as it’s simply not working, with a CPA five times their LTV.

In the fictitious example of Low Fidelity, their budget of £5,000 could theoretically produce nearer 430+ sales in a month if they funneled everything into Facebook and its £11.43 CPA remained steady.

Tracking all of this is the next challenge. Google Analytics is a great out-of-the-box tool to get the basics down, but there are other options too like Kissmetrics, Mixpanel, Rakuten, and Adobe Marketing Cloud. A developer can take any of these platforms to the next level with tracking triggers embedded on a deeper level within your site.

Google’s ecommerce tracking can take the prices, tax, shipping costs and more into account and track when a customer makes a purchase online. These things can be tracked in other systems, but inside Google Analytics you can then cross-reference them with the channel they came from.

Google also provides a system called the Urchin Tracking Module, or more commonly just UTM to help track specific campaigns. These are invaluable for email campaigns, in part to simply ensure your email traffic is sent to its own bucket, but also to then subdivide that traffic by particular campaign, or even variants of an email within a campaign.

UTMs can in fact be used anywhere you expect a user to click a link to your site. Facebook is another example where you can use them to attach more info to the link. All they consist of is a string of parameters after the URL you’re using. Google Analytics looks out for them and attributes traffic to the channel you’ve stated the URL relates to.

You can even use UTMs in offline campaigns by combining their powers with a link shortening service like bit.ly. A flyer, poster or mailout can have a nice short link for the user, which then redirects to your full UTM-decorated landing page URL.

It’s not perfect, as many offline users may simply search for your company, but knowing how many people used the link is still very valuable, and it’s set up in a matter of seconds using Google’s URL builder.

Another offline channel that you might initially assume was untrackable is the phone. On mobile nowadays you can track a click of a number on your site, but you can also do a lot more with call tracking services like Response Tap, Mediahawk, and Infinity Tracking.

Call tracking services can attribute actual online user sessions from your customers to calls they make to your numbers. In some cases this means a static number they give you for a particular campaign (like a UTM+shortlink for a phone number!) or if the call is made from your site it’s a dynamic number that changes for every user.

These services can even send data to your analytics platform of choice, letting you see the traffic’s channel source alongside whether they made a call or not.

In the modern age of online business, data is the key to simplifying previously intimidating decisions and making a tidy profit. Our fictitious record company Low Fidelity saw the possibility of turning 300 sales into 430+ sales - a 43% increase.

Measuring all that data can require constant vigilance, but with a properly implemented analytics platform the solution can be served up in real-time, with every variable worked out for you.

The solution to an initially daunting problem can then become the heart of an evolving business, with new and growing channels held to account side-by-side.

Ready to boost your advertising potential? Incorporate dynamic data analysis into your strategy with help from our expert team.

If you want to showcase your offering, convert more leads, provide resources, or all of the above, we can build a website that separates you from the competition.